greenville county property tax estimator

You can call the Greenville County Tax Assessors Office for assistance at 864-467-7300. Greenville South Carolina 29601.

South Carolina Property Tax Calculator Smartasset

While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and county in which your property is located and entering the approximate Fair Market Value of your property into the calculator.

. For comparison the median home value in South Carolina is 13750000. School 4 days ago Calculate. You can click the More Information link to.

Learn all about Greenville County real estate tax. 301 University Ridge Suite 1000. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Greenville County.

Greenville County collects on average 066 of a propertys assessed fair market value as property tax. --Select one-- Camper - 1050 Vehicle Business - 1050 Vehicle Individual - 600 Watercraft - 1050. South Carolina is ranked 1523rd of the 3143 counties in the United States in order of the median amount of property taxes collected.

Often your questions can be answered quickly via email. Please call the assessors office in Greenville before you send documents or if you need to schedule a meeting. There are typically multiple rates in a given area because your state county local schools and emergency responders each receive funding partly through these taxes.

Ultimate Greenville Real Property Tax Guide for 2022. If you have general questions you can call the Town of. VIN SCDOR Reference ID County File.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Remember to have your propertys Tax ID Number or Parcel Number available when you call. Whether you are already a resident or just considering moving to Greenville to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

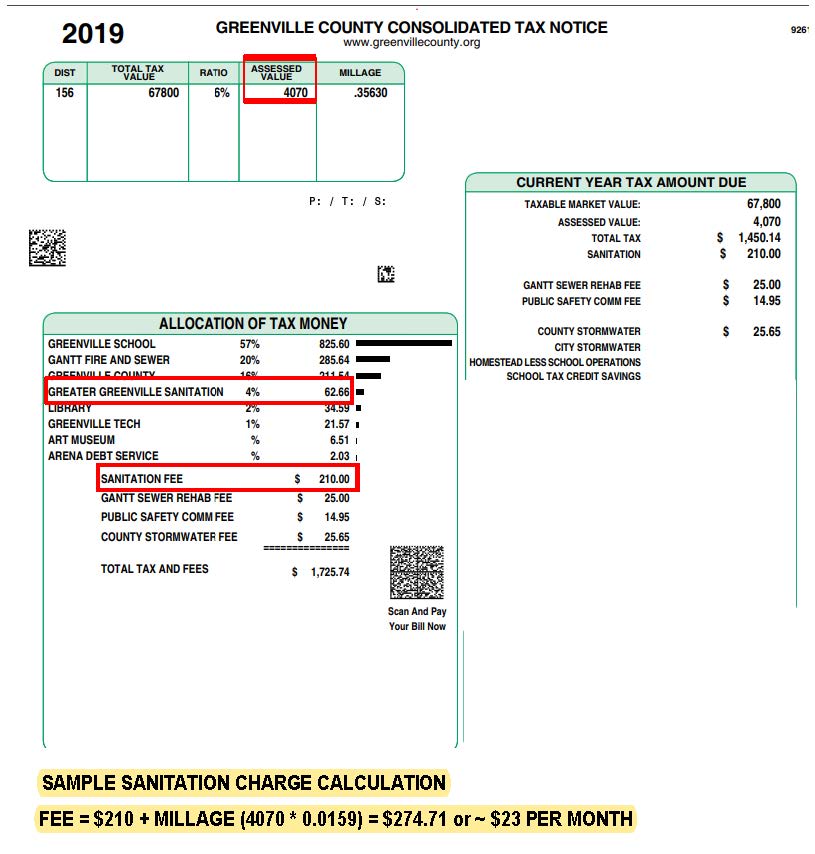

SC assesses taxes at a 4 rate for owner-occupied homes and at a 6 rate for other properties. This calculator is designed to estimate the county vehicle property tax for your vehicle. Estimated Range of Property Tax Fees.

Please make your check payable to Greenville County Tax Collector and mail to. 864 467 7300 Phone 864 467 7440 Fax The Greenville County Tax Assessors Office is located in Greenville South Carolina. Whether you are already a resident or just considering moving to Greenville County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

Tax amount varies by county. The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a. No title work after 345 pm in the Motor Vehicle Department.

Lexington County makes no warranty representation or guaranty as to the content sequence accuracy timeliness or completeness of any of the database information provided herein. The reader should not rely on the data provided herein for any reason. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

The median property tax on a 14810000 house is 155505 in the United States. Please note that we can only estimate your property tax based on median property taxes in your area. The median property tax on a 14810000 house is 97746 in Greenville County.

You can call the Town of Greenville Tax Assessors Office for assistance at 207-695-2421. Search Vehicle Real Estate Other Taxes. Greenwood County Tax Estimator South Carolina SC.

Search for Voided Property Cards. The median property tax on a 14810000 house is 97746 in Greenville County. The median property tax on a 13750000 house is 68750 in South Carolina.

Get driving directions to this office. For an estimation on county taxes please visit the Greenville county or Laurens county. Tax rates vary according to the authorities ie school fire sewer that levy tax within individual tax districts of Greenville County.

Please call the assessors office in Greenville before you. Real Property Tax Estimator - Greenville County. The median property tax on a 14810000 house is 74050 in South Carolina.

The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a median effective property tax rate of 066 of property value. 864 467 7300 Phone 864 467 7440 Fax The Greenville County. Tax Collector Suite 700.

Please Enter Only NumbersTax District. What this means is that if the marketappraisal value of your property is 180000 the assessed value is 7200 if you live in the home as your primary residence and 10800 if you use the property as a rental or vacation home or. Lexington County Coronavirus Covid19 Information.

This website is a public resource of general information. Pay by Phone for Property Tax. 866-549-1010 Bureau Code 8488220.

County functions supported by GIS include real estate tax assessment law enforcementcrime analysis economic development voter registration planning and land development. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys. Greenville County collects relatively low property taxes and is ranked in the bottom half of all counties in the United States by.

If you have documents to send you can fax them to the Greenville County assessors office at 864-467-7440. Only search using 1 of the boxes below. 005 - HORSE CREEK DUNKLIN FIRE 007 - SPEC ABATE CORRECTION COLL 008 - SPEC ABATE CORRECTION REF 015 - POSSUM KINGDOM S GVL FIRE 025 - COLUMBIA ANDERSON SCH-DUNKLIN 026 - POSSUM.

The median property tax in Greenville County South Carolina is 971 per year for a home worth the median value of 148100. Our mission is to provide accurate and timely geographic information system access technical assistance and related services to meet the needs of County operations.

Moving To Greenville Sc 10 Things You Ll Love About Your Move To Greenville Sc

Four Reasons Why You Should Locate Your Business In Greenville South Carolina Greenville Area Development Corporation

Greenville County Council Candidates Answer Our Questions Bike Walk Greenville

Ultimate Guide To Understanding South Carolina Property Taxes

Why Land Values Are Rising In Greenville County South Carolina

How Greenville County Assesses Taxes The Home Team

What Does Annexing Actually Mean For Greenville And You Gvltoday

Want To Rent Your House Well You Re Going To Have To Pay Up Greenville Journal

Fees Annexation Greater Greenville Sanitation

2022 Best Places To Buy A House In Greenville County Sc Niche

Water Bill Rate Hikes For East Side Greenville County Homes

Tax Rates Hunt Tax Official Site

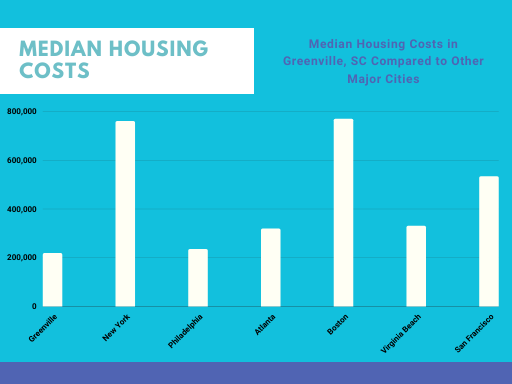

Greenville Cost Of Living Greenville Sc Living Expenses Guide

Moving To Greenville Sc 10 Things You Ll Love About Your Move To Greenville Sc